What we offer

Financing of receivables with a maturity of 60 – 180 days, mainly in the field of telecommunications in standard currencies: CZK, EUR, USD.

We offer our services to large multinational corporate companies, as well as to small companies – there is no limit applied to their number or the amount of financed receivables.

Receivables redemption processing

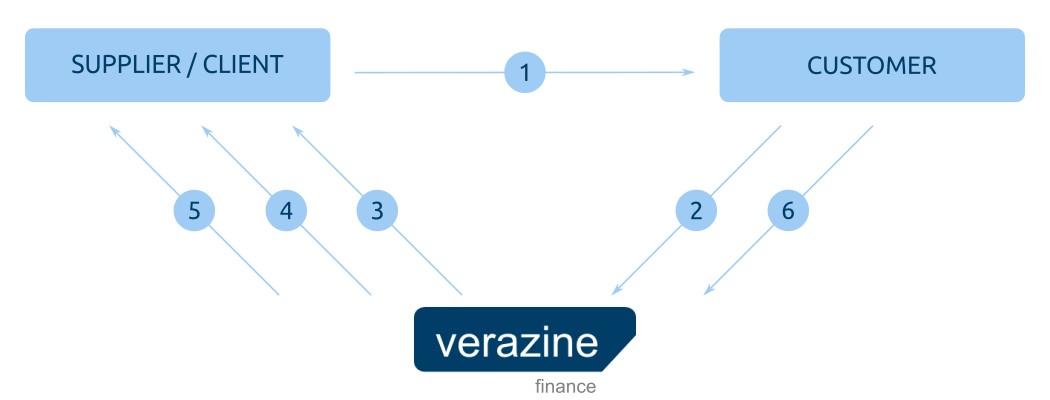

After signing a factoring contract between VERAZINE a.s. and the Client/Supplier, the following process of claims redemption starts.

- The Supplier/Client delivers goods/services to the Customer and issues an invoice

- The Supplier/Client sends VERAZINE a.s. a list of approved invoices designated for assignment (once a week)

- VERAZINE a.s. pays the Supplier/Client an advance for factoring performance – up to 100% of the nominal value of the claim (within 3 days max.)

- VERAZINE a.s. sends the Supplier/Client a payment notice

- VERAZINE a.s. sends an invoice – a summary tax document for the factoring fee and the interest for the receivables assigned in the given month (once a month)

- Payment of the claim by due date by the Customer

Financing conditions

-

Factoring fee

Factoring fee

Agreed payment for the factoring company’s activity, calculated as a percentage of the nominal value of the claim.

-

Factoring interest

Factoring interest

The contractual interest rate reflects the floating reference interest rate of the interbank market for the following currencies: CZK (PRIBOR), EUR (EURIBOR) and USD (SOFR).

-

Documents required for contract conclusion

Documents required for contract conclusion

Transcript from the Commercial Register (OR)

Economic results for the last year

Bank connection

Contact person, telephone, email

About us

Our company

Factoring company VERAZINE a.s. is a financial company that offers clients financing of their receivables with a longer maturity in the form of factoring.

Our goal

The company´s objective is to provide our clients with the highest quality of services and quick and reliable solutions of their needs.

Who we are

We are a company with exclusively Czech capital operating in the market since 2014.

Our partners

Factoring

Factoring is a financial instrument that ensures operational financing to companies. The principle of factoring is based on assigning receivables arising from deliveries of goods or services to customers.

The factoring company thus becomes the creditor to the receivables which are usually 60 – 180 days overdue.

We use the following types of factoring:

Non-recourse domestic factoring

This is our most frequently used product, where we finance 100% of the nominal value of the claim, plus factoring fee, and factoring interest is deducted from the value of the factoring performance. In this way, we finance receivables from domestic and foreign customers.

Recourse domestic factoring

We finance up to 90% of the nominal value of the claim and charge the factoring interest according to the amount that the customer actually pays up on the claim.

Export factoring

This mode of claim financing applies to customers located abroad. Depending on the creditworthiness of the client/customer, these claims can be financed both by recourse and non-recourse factoring.

Criteria of eligible receivables

- The client must be the sole creditor of the claim

- The claim was properly established, without factual or legal defects, and it not subject to any disputes

- The claims are not encumbered by any third party rights

- The claims have a maximum maturity of 180 days

Advantages of factoring

- Payment of up to 100% of the nominal value of the claim

- The frame amount is set without limitations

- Quick procedure – approved claims are paid within up to 3 days

- There is no need for any collateral

- Flexible management of the company´s cash flow

- No increase of the company´s credit limit at banking institutions

- Simplicity of the entire process and administration

- No additional fees are charged

Documents required for contract conclusion

- Transcript from the Commercial Register (OR)

- Economic results for the last year

- Bank connection

- Contact person, telephone, email

Contacts

The company´s registered domicile

VERAZINE a.s.

náměstí Republiky 1078/1, Nové Město

110 00 Praha 1

Česká republika

IČ (Comp. ID No.): 016 30 831, DIČ (VAT No.) CZ01630831

Incorporated in the Commercial Register administered by the Municipal Court in Prague, Volume B, File 19 095

Mailing address

VERAZINE a.s.

Heršpická 11b Show on map

639 00 Brno

Česká republika

Phone: +420 539 003 450, e-mail: factoring@verazine.cz

Miroslav Doubek, e-mail: doubek@verazine.cz